Seasonality explains our drop in Sales this November, as it does every year.

The November 2015 PMPA Business Trends Report Sales Index came in at 108, down 11 points from October, and virtually at the 12 month moving average of 108.8. The indicators that declined, Sales Index, Hours of First Shift Scheduled, and sentiment for Employment are explained, we feel, by seasonal, rather than market weakness. The factors that improved, and in some cases improved markedly, include sentiments for Sales, Lead Times and Profitability for the next three months. With 44% of shops scheduling First Shift Overtime, the argument that the market is weak is not convincing.

Seasonality explains our drop in Sales at this time, as it does every year.

Full report

Tag: PMPA Business Trends Report

The PMPA Business Trends Report for March 2014 hit 129, a new high for the indicator of precision machining industry shipments in US and Canada.

67 companies provided data on shipments as well as first shift hours scheduled and sentiment for three months going forward for sales, profitability, lead times and employment.

“The March 2014 PMPA Business Trends Report shows that our precision machining industry has reached a record level of shipments, but sentiments softened across all areas that we measure. While we show positive levels of hours worked, shipments, overtime and profitability, each of these indicators has softened to a less bullish level than in January and February. Our indicators suggest perhaps moderation in demand for our products in the months ahead.”

Read the full report here

Manufacturing Sector continues to grow and strengthen in February according to ISM PMI index, confirming PMPA’s own January Business Trends Outlook.

“Optimism in terms of demand and growth in the near term” – Bradley Holcomb, Institute for Supply Management

“The February PMI® registered 53.2 percent, an increase of 1.9 percentage points from January’s reading of 51.3 percent indicating expansion in manufacturing for the ninth consecutive month. The New Orders Index registered 54.5 percent, an increase of 3.3 percentage points from January’s reading of 51.2 percent. The Production Index registered 48.2 percent, a decrease of 6.6 percentage points compared to January’s reading of 54.8 percent. Inventories of raw materials increased by 8.5 percentage points to 52.5 percent. As in January, several comments from the panel mention adverse weather conditions as a factor impacting their businesses in February. Other comments reflect optimism in terms of demand and growth in the near term.”

Link here

Markets the precision machining industry serves did well in February: Machinery; Plastics & Rubber Products; Transportation Equipment; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Furniture & Related Products; Primary Metals according to the ISM release.

The PMPA’s January Business Trends Report was similarly upbeat with strongly positive indicators for Sales, Lead Times, Profitability and Employment.

Over 59% of our reporting precision machining shops were scheduling overtime in January.

The ISM PMI Report for February 2013 shows continued growth and strength in the manufacturing sector.

The ISM report confirms this statement with its report on commodity prices

“No commodities are reported down in price.”

That pretty much validates the index…

PMPA’s Business Trends Index of Shipments fell to 100 in September, a non-seasonal move that shows our industry shipments gain for the year slipping to just 102% year to date.

September shipments are just 88% of same month last year.

The slump in sales was widespread in September; of 92 companies reporting this month, only nineteen (19) were in positive territory, and just ten (10) of those in the double digits. Seventy–three (73) firms reported declines, and sixty-three (63) of those reported double digit sales declines compared to prior month.

The three month moving average (3 MMA) for sales has fallen below the 12 MMA for the second month in a row. This indicates that our industry’s shipments are no longer growing.

While we still have confidence in our industry’s ability to record a very positive increase in shipments by year end, we are aware of the “regular and special causes” that seem to be suppressing orders and shipments at this time.

The “regular causes” that we see operant are the stagnation of demand in the broad economy. We believe that this is exacerbated by the “special causes” of the present uncertainty of the 1) November election and 2) Spending cuts mandated by the looming ‘Fiscal Cliff.’

Precision machined products are crucial components that perform vital functions in critical technologies including anti lock brake, airbag depoyment, HVAC, fluid power, aerospace, and medical device (including implant) applications. According to the latest U.S. Census Report precision machining industry shipments totalled $13.3 billion in 2010.

See the full report for detailed outlook on Sales, Lead Times, Profitability, and Employment.

Despite the declines reported for May 2012 in both the ISM Purchasing Managers Index for Manufacturing and Industrial Production (IP), PMPA’s Business Trends Sales Index is once again back at its peak of 127.

This is an increase of 9 percent over April, up 8 percent over last year’s average, and up 7 percent compared to same year to date last year.

PMPA’s Business Trends Sales Index shows a strong continued demand for the products of the precision machining industry.

The ISM Manufacturing PMI decreased modestly from 54.8 percent to 53.5 percent in May 2012, contrasting to our index’s gain. Industrial Production (IP) also slipped 0.1 lower in May, as Manufacturing Activity contracted 0.4%. (Note: Manufacturing Activity is actually up 5.2% on a year over year basis.)

The 3 month moving average (3MMA) for PMPA’s Business Trends Index of Sales remains above the 12 month moving average (12MMA).

We are strongly optimistic about prospects for manufacturing knowing the role our industry’s production plays as supplier of critical componentry in manufactured goods.

How is your shop doing? Are you getting your share of the Industry’s unexpectedly strong sales?

How do you reconcile this to all the doom and gloom we hear on the news?

“The PMI registered 53.4 percent, an increase of 1 percentage point from February’s reading of 52.4 percent, indicating expansion in the manufacturing sector for the 32nd consecutive month. The Production Index increased 3 percentage points from February’s reading of 55.3 percent to 58.3 percent, and the Employment Index increased 2.9 percentage points to 56.1 percent. Of the 18 industries included in the survey, 15 are experiencing overall growth.”

Primary Metals and Fabricated Metals are two of the industries showing continued growth.

Steel, Aluminum, Copper, Oil and Fuel were all reported to be up in price; Steel was also reported lower in price in certain markets.

PMPA’s February Business Trends Report showed respondents sales to be up 11% over same month last year. Average length of first shift for february was 43.7 hours- 62 % of shops reporting were scheduling more than 40 hour shifts.

The PMPA Business Trends Report confirms the ISM findings regarding the continuing growth / expansion of manufacturing. Like the ISM Manufacturing PMI Report, and our Fabricated Metal market sector, the precision machining industry is maintaining a growing sales base, positive trends, and increased employment.

That’s how we see it.

How does it look where you are?

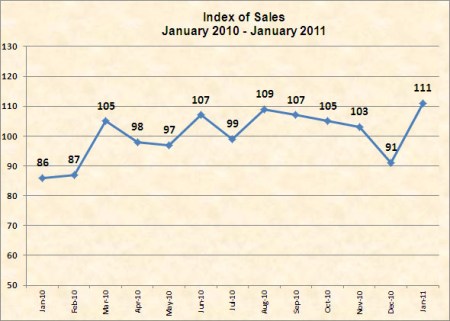

This graph is pretty clear.

PMPA’s Index of Sales of Precision Machined Products in February 2011 was 110, staying even with the adjusted value for January 2011. (January had been reported at 111.) February’s index of 110 remains at its highest level in the thirty-two months since June 2008. Additional data in the February report indicated the industry is recovering nicely, and outlook is positive. The February 2011 sales level was equal to the February 2008 level prior to the Economic Recession.

This strong showing of industry sales is a clear signal that we need to adjust from our recessionary mode “hunker down” management style to a recovery mode “aggressively manage risk” methodology if we are to take full advantage of the markets today.

More than ever before, the keys to our company’s success are in our hands, not market externalitites.

PMPA members can read the full report at this link.

Accredited Press please contact PMPA for a copy of the report.

PMPA’s Index of Sales of Precision Machined Products in January 2011 was 111, its highest level in the thirty-one months since June 2008.

This is contrary to the U.S Industrial Production 0.1% decrease reported by the Federal Reserve yesterday.

http://www.federalreserve.gov/releases/g17/current/default.htm

Since our products are largely ‘built into’ the manufactured goods that the Fed’s Industrial Production number tracks, we believe that our Sales Index is an indicator of future continued strength in manufacturing. What we ‘sold’ in January will become part of other manufactured goods for February and March.

The PMPA Business Trends Index showed a surprisingly strong August.

PMPA’s Index of Sales of Precision Machined Products in August 2010 climbed to 108, a surprisingly strong showing. The 8 percent increase in industry sales helped August to tie with June for the Sales Index High of the year to date, and since May 2009. August is the 6th month of what we have termed the new normal of sales at the Year 2000 baseline. August 2010 is up 34 points over August 2009. Two thirds of our respondents reported single or double digit gains in sales in August.

Members can download the full report here.

The Witch is dead!

The National Bureau of Economic Research issued a statement that the “trough” ended in June 2009.

So how come we feel like the house fell on us?

- Inavailability of skilled machinists

- China continues to manipulate its currency;

- North American OEMS continue to try to move work to China;

- Inavailability of credit from Banks;

PMPA’s Business Trends Sales Index proclaimed “The Lost Decade” in March and “A New Normal” in April.

The Lost Decade was when our sales index returned to year 2000 levels. The New Normal is its new range at those year 2000 levels.

See our announcement here.